第1题:

The finance director of Blod Co, Uma Thorton, has requested that your firm type the financial statements in the form

to be presented to shareholders at the forthcoming company general meeting. Uma has also commented that the

previous auditors did not use a liability disclaimer in their audit report, and would like more information about the use

of liability disclaimer paragraphs.

Required:

(b) Discuss the ethical issues raised by the request for your firm to type the financial statements of Blod Co.

(3 marks)

第2题:

Your IT director has decided to allow employees to use their laptops at home as well as in the office. You have deployed the Junos Pulse client to allow access to the offices 802.1X-enabled wired network. Your company also has the Junos Pulse Secure Access Service deployed. You want the Junos Pulse client to automatically launch the appropriate access method depending on each users location.Which three are supported to determine the users location?()

A. MAC address

B. DNS server

C. DHCP server

D. resolve address

E. endpoint address

第3题:

JOL Co was the market leader with a share of 30% three years ago. The managing director of JOL Co stated at a

recent meeting of the board of directors that: ‘our loss of market share during the last three years might lead to the

end of JOL Co as an organisation and therefore we must address this issue immediately’.

Required:

(b) Discuss the statement of the managing director of JOL Co and discuss six performance indicators, other than

decreasing market share, which might indicate that JOL Co might fail as a corporate entity. (10 marks)

第4题:

第5题:

第6题:

The managing director would bear the ____ for the accident, although it was not really his fault.

A、guilt

B、charge

C、blame

D、accusation

第7题:

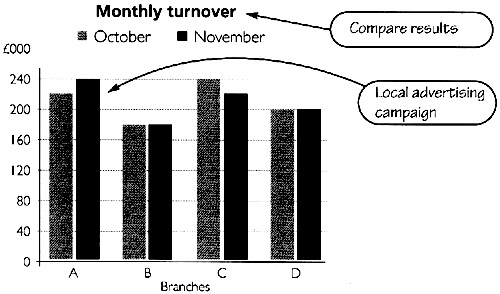

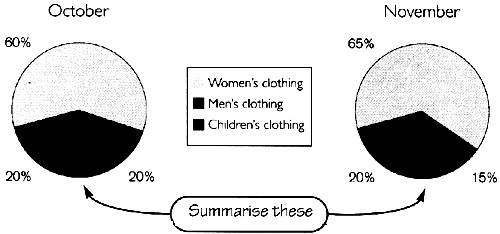

—You work for a small chain of clothing stores. The Managing Director has asked you to write a short report on last month's performance.

—Look at the charts and table below, on which you have already made some handwritten notes.

—Then, using all your handwritten notes, write the report for your Managing Director

—Write 120-140 words.

第8题:

4 You are a senior manager in Becker & Co, a firm of Chartered Certified Accountants offering audit and assurance

services mainly to large, privately owned companies. The firm has suffered from increased competition, due to two

new firms of accountants setting up in the same town. Several audit clients have moved to the new firms, leading to

loss of revenue, and an over staffed audit department. Bob McEnroe, one of the partners of Becker & Co, has asked

you to consider how the firm could react to this situation. Several possibilities have been raised for your consideration:

1. Murray Co, a manufacturer of electronic equipment, is one of Becker & Co’s audit clients. You are aware that the

company has recently designed a new product, which market research indicates is likely to be very successful.

The development of the product has been a huge drain on cash resources. The managing director of Murray Co

has written to the audit engagement partner to see if Becker & Co would be interested in making an investment

in the new product. It has been suggested that Becker & Co could provide finance for the completion of the

development and the marketing of the product. The finance would be in the form. of convertible debentures.

Alternatively, a joint venture company in which control is shared between Murray Co and Becker & Co could be

established to manufacture, market and distribute the new product.

2. Becker & Co is considering expanding the provision of non-audit services. Ingrid Sharapova, a senior manager in

Becker & Co, has suggested that the firm could offer a recruitment advisory service to clients, specialising in the

recruitment of finance professionals. Becker & Co would charge a fee for this service based on the salary of the

employee recruited. Ingrid Sharapova worked as a recruitment consultant for a year before deciding to train as

an accountant.

3. Several audit clients are experiencing staff shortages, and it has been suggested that temporary staff assignments

could be offered. It is envisaged that a number of audit managers or seniors could be seconded to clients for

periods not exceeding six months, after which time they would return to Becker & Co.

Required:

Identify and explain the ethical and practice management implications in respect of:

(a) A business arrangement with Murray Co. (7 marks)

第9题:

第10题: