If XYZ LTD needs to sign a contract that includes infrastructure design, deployment,support services and applications, what would be the best option?()

第1题:

(b) Calculate the corporation tax (CT) liabilities for Alantech Ltd, Boron Ltd and Bubble Ltd for the year ending

31 December 2004 on the assumption that loss reliefs are taken as early as possible. (9 marks)

(b) Schedule D Case I calculation

The three companies form. a group for both group relief and capital gains purposes as all shareholdings pass the 75%

ownership test. The calculation of the corporation tax liabilities is as follows:

第2题:

5 Gagarin wishes to persuade a number of wealthy individuals who are business contacts to invest in his company,

Vostok Ltd. He also requires advice on the recoverability of input tax relating to the purchase of new premises.

The following information has been obtained from a meeting with Gagarin.

Vostok Ltd:

– An unquoted UK resident company.

– Gagarin owns 100% of the company’s ordinary share capital.

– Has 18 employees.

– Provides computer based services to commercial companies.

– Requires additional funds to finance its expansion.

Funds required by Vostok Ltd:

– Vostok Ltd needs to raise £420,000.

– Vostok Ltd will issue 20,000 shares at £21 per share on 31 August 2008.

– The new shareholder(s) will own 40% of the company.

– Part of the money raised will contribute towards the purchase of new premises for use by Vostok Ltd.

Gagarin’s initial thoughts:

– The minimum investment will be 5,000 shares and payment will be made in full on subscription.

– Gagarin has a number of wealthy business contacts who may be interested in investing.

– Gagarin has heard that it may be possible to obtain tax relief for up to 60% of the investment via the enterprise

investment scheme.

Wealthy business contacts:

– Are all UK resident higher rate taxpayers.

– May wish to borrow the funds to invest in Vostok Ltd if there is a tax incentive to do so.

New premises:

– Will cost £446,500 including value added tax (VAT).

– Will be used in connection with all aspects of Vostok Ltd’s business.

– Will be sold for £600,000 plus VAT in six years time.

– Vostok Ltd will waive the VAT exemption on the sale of the building.

The VAT position of Vostok Ltd:

– In the year ending 31 March 2009, 28% of Vostok Ltd’s supplies will be exempt for the purposes of VAT.

– This percentage is expected to reduce over the next few years.

– Irrecoverable input tax due to the company’s partially exempt status exceeds the de minimis limits.

Required:

(a) Prepare notes for Gagarin to use when speaking to potential investors. The notes should include:

(i) The tax incentives immediately available in respect of the amount invested in shares issued in

accordance with the enterprise investment scheme; (5 marks)

第3题:

A.错误

B.正确

第4题:

第5题:

A.Createad.contoso.comasastandardprimaryDNSZone.

B.Createad.contoso.comasanActiveDirectoryIntegratedDNSZone.

C.EnableonlyauthorizedclientcomputerstoupdateDNS.

D.ConfigureazonetransferbetweentheDNSserverattheISPandtheDNSserversatContoso.Ltd.

第6题:

(c) Calculate the expected corporation tax liability of Dovedale Ltd for the year ending 31 March 2007 on the

assumption that all available reliefs are claimed by Dovedale Ltd but that Hira Ltd will not claim any capital

allowances in that year. (4 marks)

第7题:

(XYZ+XYZ+XYZ+XYZ+XYZ+XYZ)=(97)。

A.YZ

B.Y+Z

C.YZ

D.Y+Z

第8题:

(b) Advise the management of SCC Ltd of THREE strategies that should be considered in order to improve the

future performance of SCC Ltd. (6 marks)

第9题:

A.UpgradetheNewYorkdomain.UpgradetheChicagodomain.CreateapristineforestforContoso,Ltd.

B.Createapristineforest.UpgradetheNewYorkdomain.UpgradetheChicagodomain.Donothingfurther.

C.Createpristineforest.UpgradetheNewYorkdomain.UpgradetheChicagodomain.CreateapristineforestforContoso,Ltd.

D.Createapristineforest.UpgradetheNewYorkdomain.UpgradetheChicagodomain.CreateanewchilddomainforContoso,Ltd.

第10题:

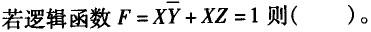

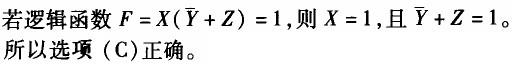

若逻辑函数则()。