Rate of return(or return)on capital 资本收益率(或资本收益)

第1题:

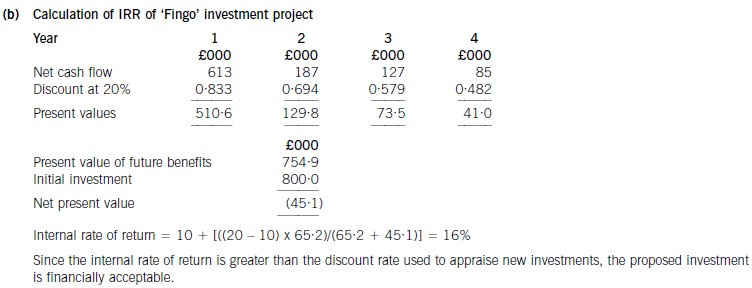

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

第2题:

(ii) Briefly discuss TWO factors which could reduce the rate of return earned by the investment as per the

results in part (a). (4 marks)

第3题:

Which of the following is referred to as payback period:

A . the number of periods required to recover the initial investment

B . the rate of return on the investment

C . the number of periods required to bring project cost back to the original budget, based on current performance

D . loan payment schedule

E . None of the above

第4题:

A.publicintblipvert(intx){return0;}

B.privateintblipvert(intx){return0;}

C.privateintblipvert(longx){return0;}

D.protectedlongblipvert(intx,inty){return0;}

E.protectedintblipvert(longx){return0;}

F.protectedlongblipvert(longx){return0;}

G.protectedlongblipvert(intx){return0;}

第5题:

下列函数的功能是【 】。

include<iostream. h>

int Func(int a,int b)

{

if (a>b) return 1;

else if(a==b) return 0;

else return -1;

}

第6题:

(c) Discuss the reasons why the net present value investment appraisal method is preferred to other investment

appraisal methods such as payback, return on capital employed and internal rate of return. (9 marks)

第7题:

Rate of return(or return)on capital 资本收益率(或资本收益)

在一项投资或一件资本品上的收益(yield)。比如,一项耗费100美元的投资每年带来12美元的收益,那么这项投资的收益率就是每年12%。

第8题:

A.strcmp1(char *s, chat *t)

{ for ( ;*s++==*t++ ;)

if (*s=='\0') return 0

return (*s-*t)

}

B.strcmp2(char *s, char *t)

{ for( ;*s++==*t++ ;)

if (!*s) return0

return (*s-*t)

C.strcmp3(char *s, char *t)

{ for ( ;*t==*s ;)

{ if (!*t) return 0

t++

s++}

return (*s-*t)

}

D.strcmp4(char *s, char *t)

{ for( ;*s==*t;s++,t++)

if (!*s) return 0

return (*t-*s)

}

第9题:

A.publicintblipvert(intx){return0;}

B.privateintblipvert(intx){return0;}

C.privateintblipvert(longx){return0;}

D.protectedintblipvert(longx){return0;}

E.protectedlongblipvert(longx){return0;}

F.protectedlongblipvert(intx,inty){return0;}

第10题:

A.publicintmethod1(inta,intb){return0;}

B.privateintmethod1(inta,intb){return0;}

C.privateintmethod1(inta,longb){return0;}

D.publicshortmethod1(inta,intb){return0:}

E.staticprotectedintmethod1(inta,intb){return0;}