第1题:

第2题:

什么是金属热强度?其在工程中的实际意义是什么?

第3题:

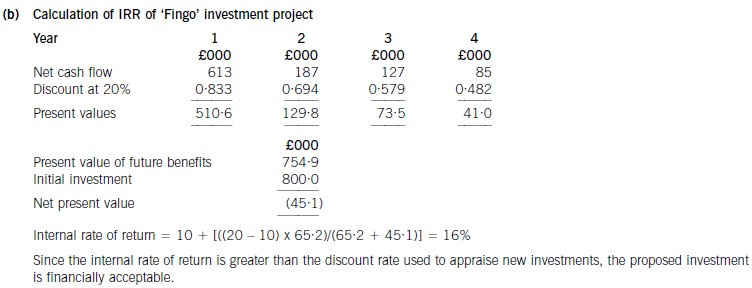

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

第4题:

什么叫简支梁桥,其特点是什么?

第5题:

什么叫地质循环?其含义是什么?

第6题:

IRR函数与RATE函数都是计算应有的投资报酬率,以下关于两个函数说法正确的是( )

A.RATE函数一定要在符合年金现金流的条件下才可以运用,而IRR函数可用于任何形态的现金流

B.IRR函数一定要在符合年金现金流的条件下才可以运用,而RATE函数可用于任何形态的现金流

C.RATE函数和IRR函数都要在符合年金现金流的条件下才可以运用

D.RATE函数和IRR函数都可用于任何形态的现金流

第7题:

什么叫压缩比?它的含义是什么?

第8题:

(c) Discuss the reasons why the net present value investment appraisal method is preferred to other investment

appraisal methods such as payback, return on capital employed and internal rate of return. (9 marks)

第9题:

什么叫接口?硬件接口和软件接口的含义各是什么?

第10题:

什么叫互斥方案?简述利用增量内部收益率(ΔIRR)对互斥方案进行比选的步骤。